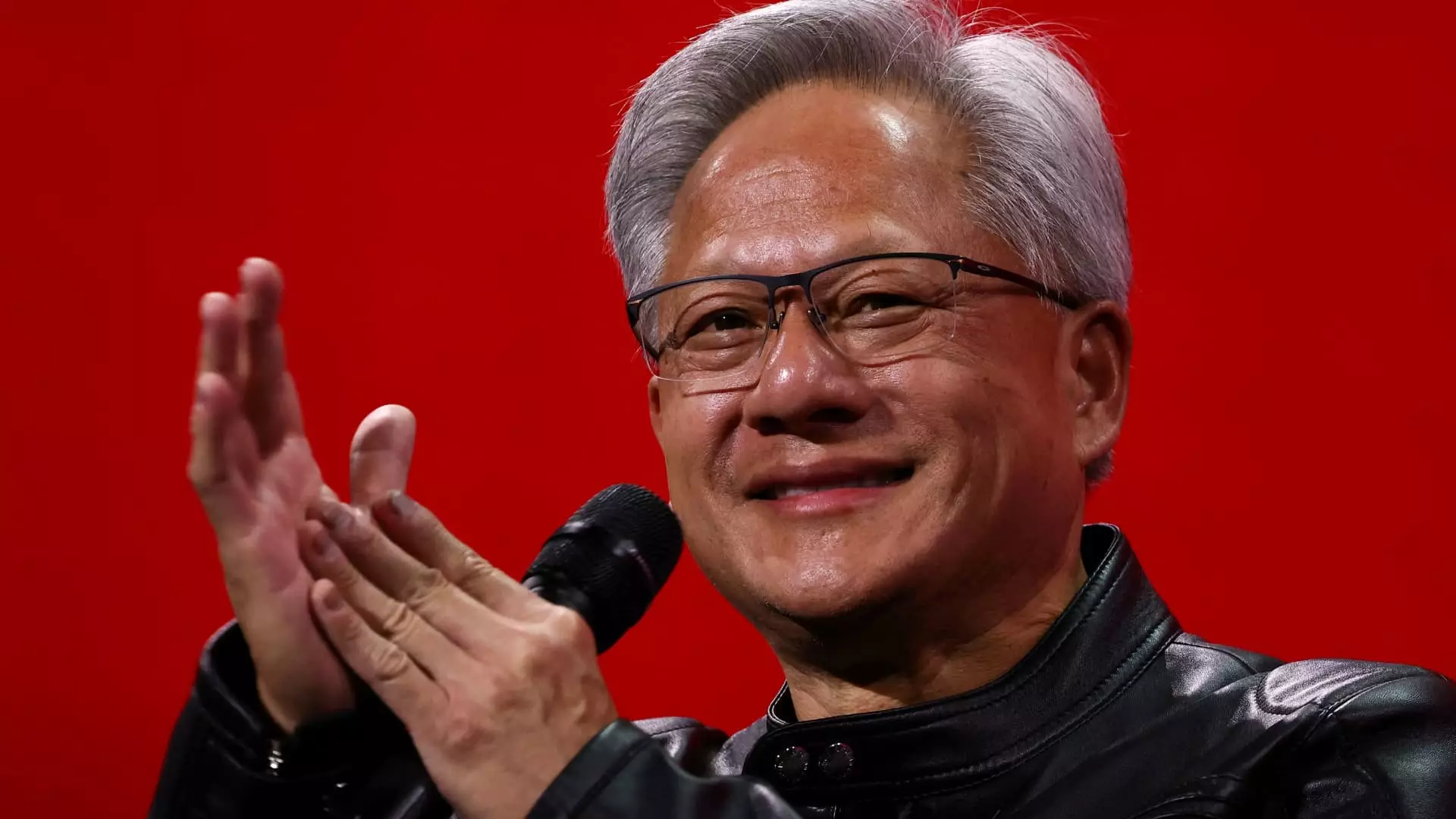

Jensen Huang, the CEO of Nvidia, is in the spotlight once again—this time for selling 100,000 shares of his own company, with a hefty price tag hovering around $15 million. Such a financial maneuver generates substantial chatter, especially when weighed against the backdrop of Huang’s broader strategy to offload a stunning total of 600,000 shares by 2025, a plan that could net him approximately $873 million. While these transactions may appear as routine financial planning to some, the implications behind them unearth layers of concern, especially for corporate governance and shareholder trust.

Nvidia’s Meteoric Rise: A Double-Edged Sword

The stunning 800% surge in Nvidia’s stock since the launch of OpenAI’s ChatGPT reveals not just corporate success, but also an intense dependence on the burgeoning AI market. The spotlight on Nvidia’s GPUs has indeed placed the company at the forefront of technological innovation, but fear lurks beneath this glittering achievement. Huang still retains a staggering portfolio of over 800 million shares, yet one cannot help but wonder: Is there an underlying cause for his significant sell-off? Are these moves reflective of a quick cash grab or a calculated exit strategy before potential market corrections?

These sales could also signal misgivings about future market conditions—especially given the troubling export controls that threaten to curtail Nvidia’s global influence in AI chip technology. While Huang’s stake remains substantial, the act of divesting raises eyebrows among investors, suggesting deeper rifts in confidence.

The Focus on Growth Amidst Challenges

Despite the questions lingering around Huang’s decisions, Nvidia’s continued growth is difficult to dispute. A reported 69% year-over-year increase in revenue to $44 billion underscores the company’s operational prowess. However, one must ponder: Can this growth narrative withstand external pressures? Critics would argue that reliance on the AI sector could backfire if those market demands shift. Nvidia’s dominance is commendable but carries the weight of vulnerability; a misstep could lead the company to a precarious edge.

A CEO’s Ethical Responsibility

In an age where corporate transparency and ethical leadership are held to high standards, Huang’s prearranged stock sales may resonate more as a red flag than judicious planning. While it is not uncommon for executives to liquidate shares, it becomes particularly concerning when significant sums are involved amidst a bright but tumultuous market backdrop. Huang’s wealth, now around $126 billion, places a moral scrutiny on his actions. Is he keenly aware of the market dynamics, or is he merely cashing in before the tide potentially turns?

Jerking the reins on his stock sales might have presented an image of stability, fostering greater confidence among investors and stakeholders. By instead choosing to sell, Huang risks alienating those who may prefer a show of conviction in the company he helped build. The repercussions of these actions may not only affect Nvidia’s standing in the market but also Huang’s legacy as a tech leader—an aspect that should weigh heavily on anyone in his position.