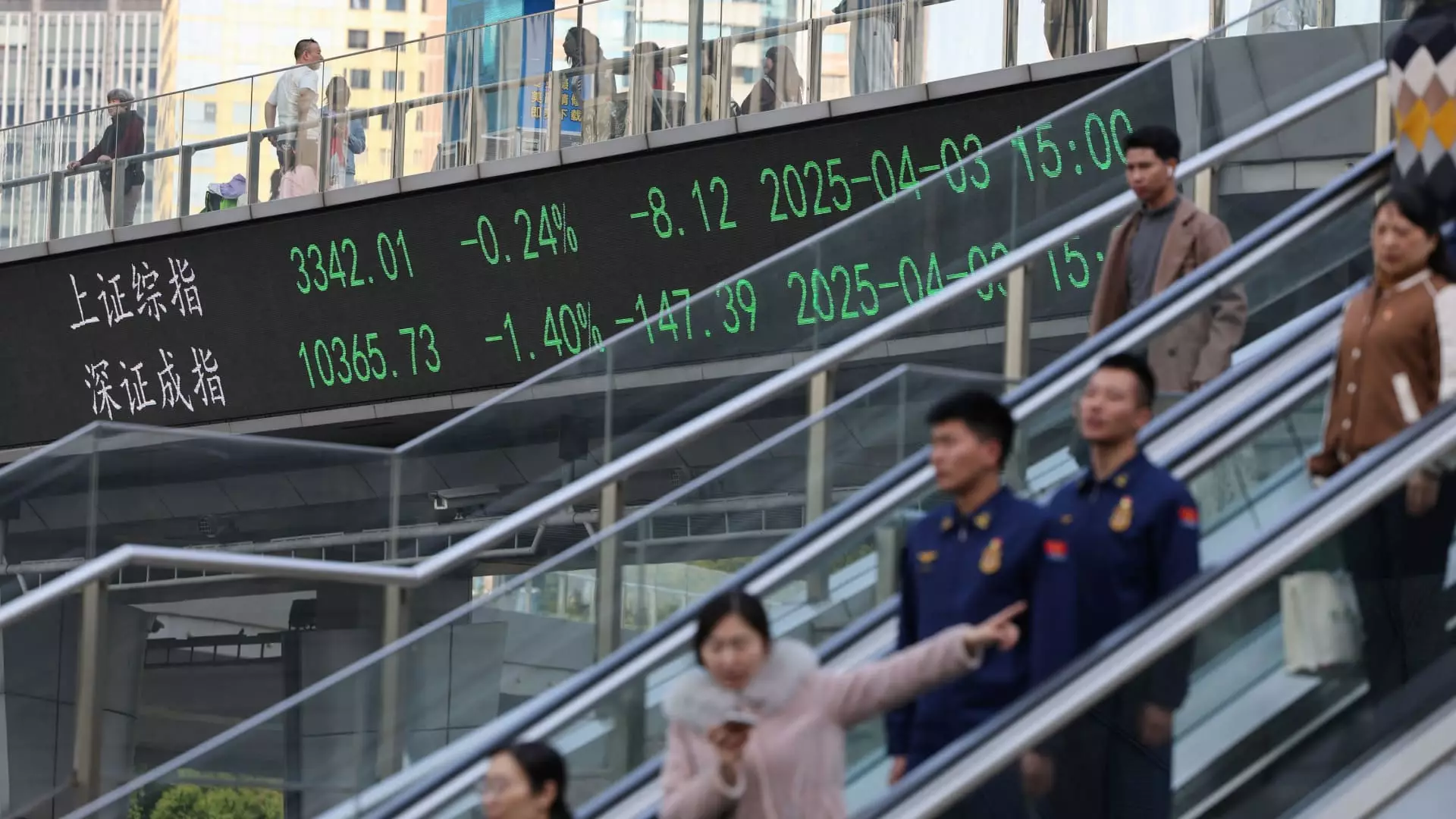

While the geopolitical landscape continues to stir anxiety among global investors, particularly concerning U.S.-imposed tariffs on China, it’s essential to scrutinize the often-overlooked resilience brewing within China’s technology sector. Rather than succumbing to panic during market fluctuations, investors need to consider the context of these fears. Analysts suggest that much of the initial shock in stock prices may stem more from overreaction than from substantial economic shifts. Despite the immediate dips recorded in the stock markets, the rebound of major Chinese technology firms signals a growing, proactive investor sentiment, especially towards homegrown innovations in generative artificial intelligence.

As the latest tariffs sent waves of trepidation through financial markets, it’s crucial to understand the landscape. Many of the big players in China’s tech industry possess a surprisingly low level of exposure to the U.S. market. This important fact, underscored by Morningstar’s Kai Wang, paints a picture of cautious optimism; rather than frantic selling, a thoughtful approach among investors might yield better long-term results. With Chinese tech stock valuations remaining attractive relative to their U.S. counterparts, this sector could provide a valuable opportunity for savvy investors looking to navigate through the tempestuous waters of trade disputes.

Private Sector Innovations: The Driving Force for Growth

Chinese enterprises are not just scrappy survivors in a global market; they are rapidly evolving into leaders in innovation. Take, for example, recent developments in generative artificial intelligence from companies like DeepSeek, which boasts an AI model that claims to surpass OpenAI’s ChatGPT, regardless of U.S. restrictions limiting access to advanced chips. Such advancements indicate a shift towards domestic innovation, which could empower Chinese firms to break free from reliance on foreign technology.

Moreover, the potential for AI adoption extends beyond mere breakthroughs; it presents a gateway for Chinese companies to optimize operations and reduce costs. This proactive approach not only enhances competitiveness but also aligns with governmental strategies aimed at stimulating consumer growth. Businesses that adapt to these technological advancements can anticipate rising earnings expectations, significantly bolstering their market positions.

Changing Investor Sentiments: A Path Towards Stability

The tide of international investor interest in Chinese tech is changing, with financial data indicating that nearly 25% of foreign investors are shifting their focus toward this sector. As global emerging markets turn their gaze toward China, allocations to this region have reached a 16-month high. This shifting sentiment reflects a deeper understanding of the long-term potential held within Chinese technology, particularly for firms focused on domestic markets rather than export-driven growth.

Analysts from Citigroup have expressed an inclination to favor domestic plays alongside service-oriented sectors, a stance that reveals a nuanced understanding of current economic conditions. As barriers continue to rise, it becomes increasingly clear that companies keeping their operations rooted within the domestic landscape stand to gain significant advantages. Stocks like Tencent and BYD exemplify this trend, signaling growth potential that is largely unscathed by external tariff pressures.

The Unsettled Terrain: Healthcare and Beyond

Interestingly, it’s not just the tech sector that stands to gain. The healthcare sector in China appears less threatened by tariffs, especially when it comes to pharmaceuticals, largely exempt from the latest U.S. sanctions. As Jefferies analysts highlight, many Chinese biopharmaceutical firms maintain partnerships with U.S. companies, thereby rendering them more insulated from direct repercussions of tariffs. This cogent observation underlines a crucial aspect of the diversified portfolio that investors could benefit from: a combined investment strategy in technology and healthcare.

While the complexities of U.S.-China relations and tariff implications demand careful consideration, sorting through these disruptions can lead to opportunities that others may miss. With bipartisan support in the U.S. for lowering drug prices, the prospects for companies like Wuxi Biologics suggest a thriving healthcare ecosystem irrespective of potential future tariffs.

A Cautious Eyes on the Horizon

Despite the promising outlook, caution is warranted. Analysts caution that the adverse impact of tariffs on China’s economy is an ever-present threat; even if technology sectors show resilience, the potential for macroeconomic repercussions looms large. As tariffs make hairline fractures in the Chinese GDP, the risk of increased market volatility also raises concerns. Investors must remain alert and informed, balancing optimism with pragmatism as they navigate through an ever-evolving marketplace.

While the effect of tariffs is a pressing concern, the underlying dynamics of China’s technology sector exhibit signs of robustness. In a landscape fraught with uncertainty, betting on resilience backed by innovation and domestic focus could yield profitable outcomes, despite the noise from geopolitical tensions. The key will be to keep a pulse on market shifts while remaining anchored by the undeniable progress being made on the ground in China.