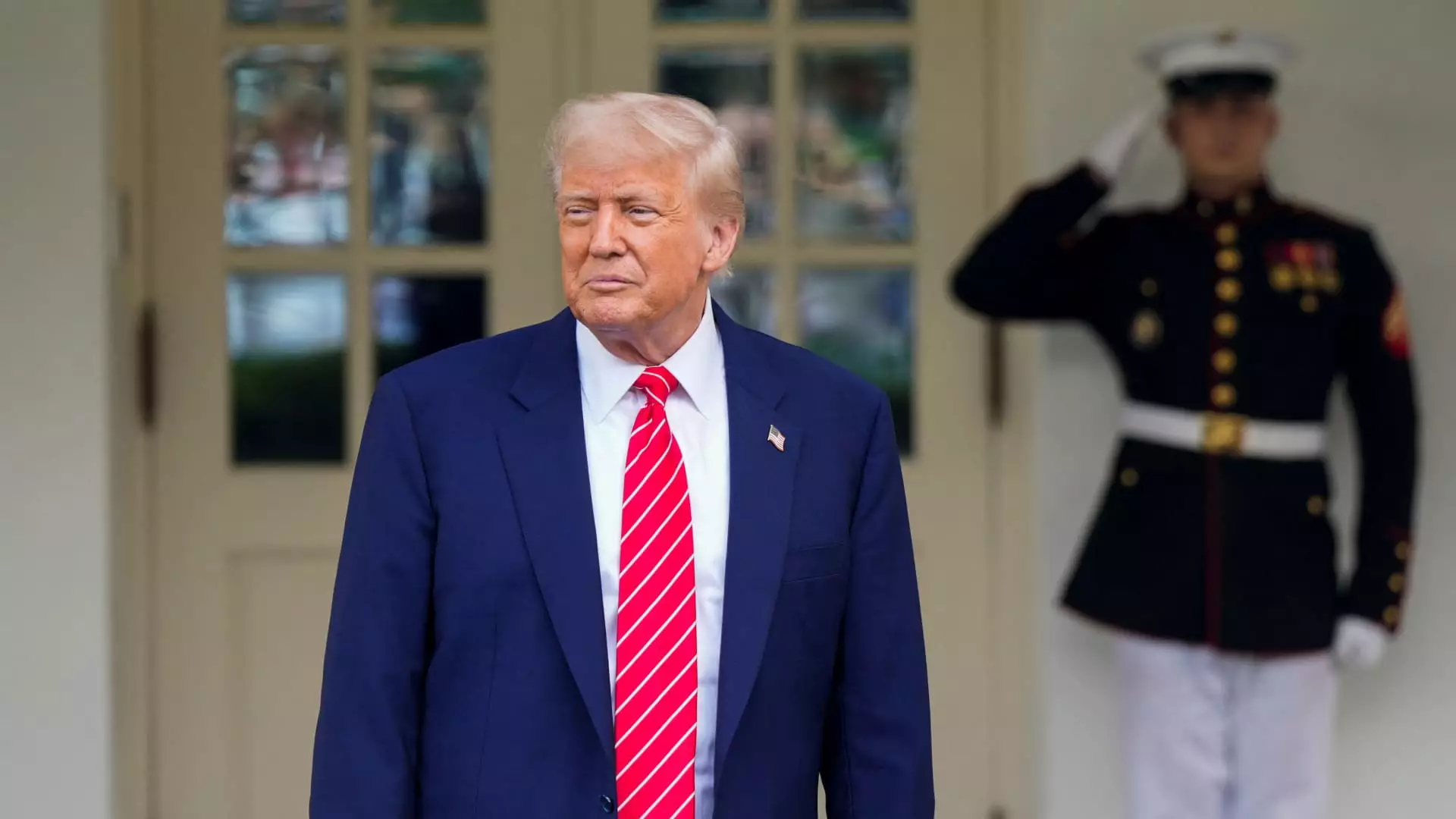

The realm of cryptocurrency has always been fraught with uncertainty and wild speculation, but under the current administration, those challenges are compounded by blatant conflicts of interest. President Donald Trump’s personal cryptocurrency ventures have become a significant roadblock in the legislative domain. The disapproval of the GENIUS Act, a proposed bill designed to regulate stablecoins, starkly illustrates the extent to which Trump’s business entanglements hinder progress. This prevents not only innovation in the crypto space but also jeopardizes the integrity of U.S. government institutions.

The Accusation: Corruption at the Core

Senator Jeff Merkley’s bold assertion that allowing Trump’s personal interests to shape crypto legislation is a “corrupt scheme” resonates profoundly in today’s political landscape. By intertwining personal profit with public service, lawmakers worry about Trump’s ability to govern without bias. When a president’s financial interests are directly linked to investments by those vying for influence, national security risks arise. This causes a crisis of ethics that is both alarming and unacceptable. Such factors are not new in political history, but the blatant nature of this conflict raises eyebrows, especially when public trust in government is already on shaky ground.

Bipartisan Hurdles: A Unity Fractured

While many believed that a bipartisan effort could lead to the ratification of the GENIUS Act, the political reality proved otherwise. Republicans face an uphill battle amid a slim majority in the House and a unified opposition from Democrats who now seem more focused on protecting their constituents than accommodating Trump’s personal agenda. The 48-49 vote outcome was not a sign of disagreement over the merits of the legislation but rather a manifestation of political maneuvering – a clear indication that lawmakers are unwilling to endorse a bill that could enrich a sitting president while jeopardizing federal oversight.

Beyond party lines, the critical resistance to passing the GENIUS Act stems from legitimate concerns over financial stability and national security. With Trump’s private crypto ventures like World Liberty Financial entwined in potential conflicts, legislators from all sides express reluctance to support initiatives that may seem to endorse or legitimize unethical practices.

Trump’s Personal Ventures: Compounding Conflicts

Just as the GENIUS Act emerged in the Senate, whispers of a new wrinkle in Trump’s financial narrative erupted: $TRUMP and $MELANIA coins, designed to intertwine his personal wealth with the cryptocurrency boom. Senators have raised alarm bells about these meme coins, calling them “pay-for-play schemes” that undermine serious discussions about cryptocurrency regulation. The idea that the president would invite top holders of his coin to dinners at the White House illustrates just how far removed he is from the notion of public service.

Moreover, Trump’s connection to investments linked to foreign entities adds another layer of complexity. The potential investment by Abu Dhabi-based MGX into the Binance crypto exchange using Trump’s stablecoin surfaces hard questions about international influence and propriety. Such dealings pose risks to national interests, particularly when they might benefit his family financially.

The Market’s Reaction: Entrepreneurs in Limbo

For many in the crypto industry, these conflicts introduce uncertainty that stifles growth and innovation. As crypto entrepreneurs share the concerns articulated by Ryan Gilbert from Launchpad Capital, they lament that personal business interests distract from the primary focus of delivering effective policy. The moment such distractions seep into legislative processes, they set a detrimental precedent that reverberates through market confidence.

As an investor, the ramifications of Trump’s conflicting interests extend far beyond failed legislation. The disillusionment surrounding the legislative process results in a chilling effect that discourages potential investments, signaling to the world that the U.S. is losing its competitive edge in the burgeoning crypto landscape.

Political Fallout: A Long-Term Impact

The fallout from this episode could resonate far into the future. Beyond the immediate complications posed by the failed GENIUS Act, the potential for broader legislative gridlock looms large. With Democrats and even some Republicans unwilling to cooperate while Trump maintains his financial entanglements, opportunities for necessary reforms grow slim.

The reputational damage inflicted on the U.S. crypto industry could be severe as well. As critics point out, this may render the nation a “laughing stock” in the global arena, leading to hesitancy in attracting competitive talent and leading innovations. As other countries progress in their cryptocurrency regulatory frameworks, the United States risks falling behind, losing its prestige and influence in a realm where it previously led the charge.

The poignant reality is that unless Trump extricates himself from his personal pursuits, genuine policy progress will remain elusive. The cryptocurrency world’s potential for revolutionizing finance is vast, but as long as Trump’s private ventures intertwine with public policy debates, the road ahead will be riddled with obstacles that stem from personal ambitions rather than public welfare.