Contemporary Amperex Technology Co. Limited (CATL) is no longer merely a supplier of batteries; it is positioning itself as an ecosystem builder in the rapidly evolving world of electric vehicle (EV) technology. While this strategic shift can be lauded as a sign of innovation, it also raises concerns about the concentration of power within a single corporation capable of dominating multiple facets of the EV supply chain. The global push towards cleaner energy and sustainable transportation has opened lucrative avenues for companies like CATL, but with this expansion comes a need for skepticism. From fostering a technological ecosystem to potentially stifling competition, CATL’s ambitions verge on creating a monopoly that could hinder innovation rather than promote it.

The development of AI-powered monitoring tools exemplifies CATL’s plan to embed advanced software into its hardware offerings. These tools are designed not just for efficient battery management but also for preemptive safety interventions. While enhancing safety is commendable, it also signals a strategic move towards control over data and technological standards that could give CATL an unfair advantage. The company’s aspirations to transition from a hardware manufacturer to a software ecosystem provider can be viewed as an effort to entrench itself at the core of the EV industry, potentially marginalizing smaller competitors and new entrants. This is reminiscent of an industry consolidator wielding influence over standards, consumer data, and technological compatibility, thereby threatening a more open and competitive landscape.

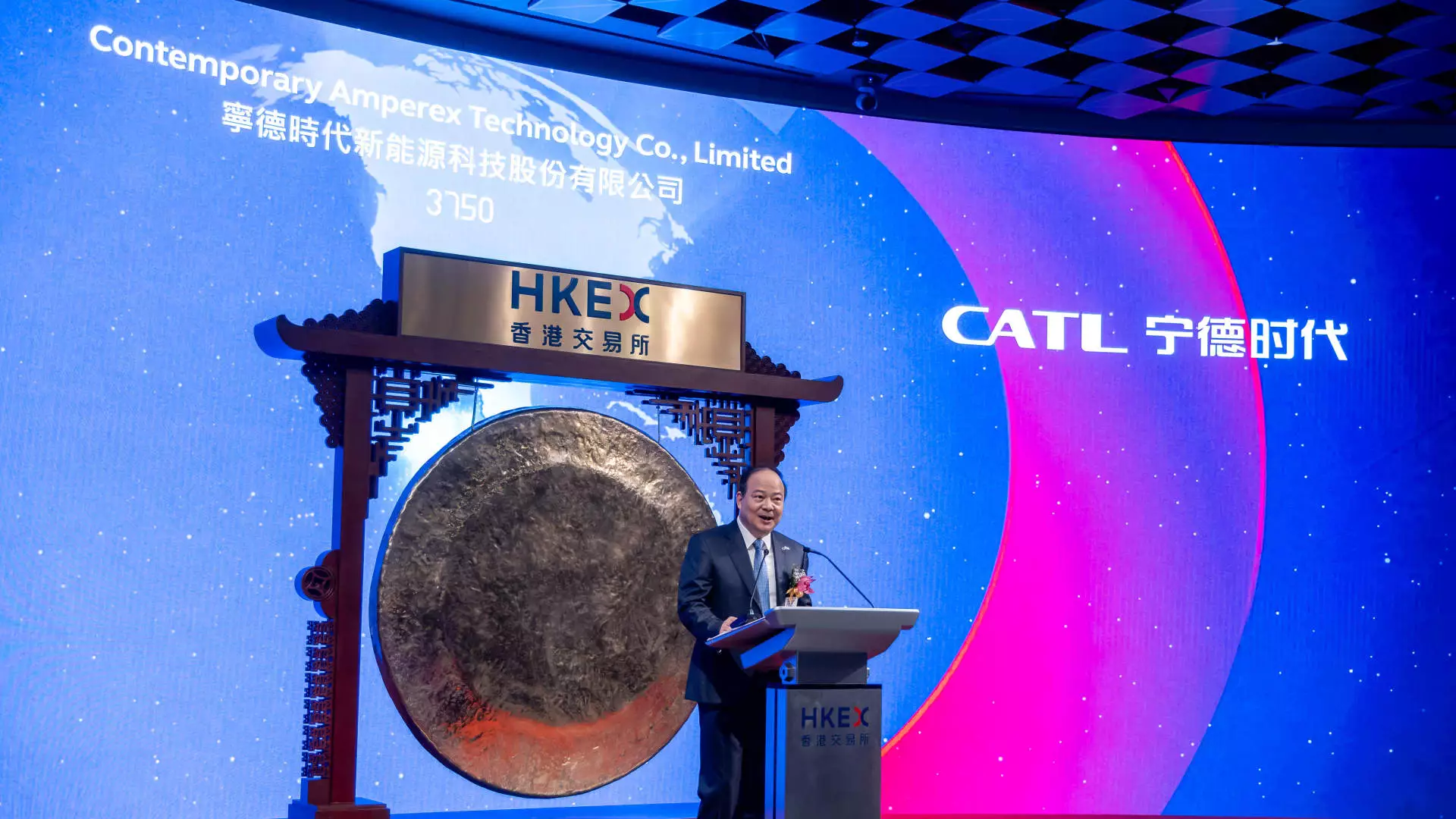

Moreover, the financial markets seem to be buying into CATL’s vision, as reflected in Morgan Stanley’s bullish projections and increased price targets. This hyped-up optimism is indicative of a company perceived as a near-monopoly rather than just a market player. The valuation premiums underpin the narrative that CATL’s future is secure, yet it also raises questions about whether markets are adequately considering the long-term risks associated with industry consolidation and geopolitical entanglements. Spotlighting its IPO success in Hong Kong, analysts seem eager to reward CATL’s aggressive expansion, even as the company’s earnings are poised to be influenced by international regulatory and political headwinds.

Geopolitical Tensions and the Risks for Western Markets

The geopolitical landscape casts a long shadow over CATL’s global ambitions. Despite its technological prowess and expansive plans, the company’s operations face mounting resistance from Western authorities, especially the United States. The Pentagon’s decision to categorize CATL on a “Chinese military” list is a bold move that highlights the security concerns tied to Chinese tech firms operating within sensitive sectors. Although CATL disputes these claims, asserting its innocence from military ties, the perception remains a significant obstacle for U.S. business and government partnerships.

This geopolitical friction underscores a broader dilemma: can a company like CATL navigate the treacherous waters of international diplomacy while maintaining its growth trajectory? The fact that the U.S. administration intends to prohibit procurement from such Chinese firms indicates a clear strategic move toward safeguarding national security interests over market innovation. The potential exclusion from American markets, with a looming ban set for 2026, could severely impact CATL’s prospects in a lucrative market segment—yet the company’s focus on expanding into Europe and other regions indicates it is not solely reliant on the American juggernaut.

European ventures, notably their factory in Hungary, demonstrate a strategic pivot to mitigate risks associated with U.S.-China tensions. However, these efforts might only partially offset the disadvantages posed by American restrictions. A significant concern for investors and industry stakeholders should be whether CATL’s international expansion can compensate for its exclusion from the U.S. market—an area where it commands substantial technological and market share. The long-term risk is that geopolitical confrontations could isolate CATL further, hobbling its potential to achieve the dominant position in global battery supply that it seemingly seeks.

Strategic Alliances and the Future of Electric Mobility

In its relentless pursuit to dominate the EV supply chain, CATL has been forging critical partnerships with automakers and tech firms worldwide. Collaborations with brands like Xiaomi and Zeekr to develop batteries optimized for hybrid and electric vehicles highlight a nuanced strategy to cover various market segments. These alliances are not only about securing sales but also about embedding CATL’s technology into a broad array of vehicles, thus entrenching its presence in diverse automotive markets.

However, this aggressive expansion into multiple sectors—ranging from nickel mining in Indonesia to high-tech battery swapping and hybrid systems—strikes an ominous note. A company wielding such extensive control over raw materials, manufacturing capabilities, and technological standards faces the danger of creating systemic dependencies that could limit innovation elsewhere. When a single enterprise simultaneously controls the supply chain, manufacturing, and licensing of critical technologies, it risks turning a competitive landscape into an insular ecosystem that discourages innovation from smaller players or new entrants.

Financial metrics reflect these ambitions—ongoing investments, licensing fees, and planned expansion into Europe suggest that CATL aims to generate sustained profit streams beyond initial hardware sales. Yet the question remains: at what cost? As industry observers and policymakers grow more wary of monopolistic tendencies, the long-term sustainability of CATL’s strategy depends on maintaining a delicate balance—harnessing high-tech innovation without quashing the competitive environment necessary for genuine progress.

While CATL’s trajectory signals impressive growth and technological progress, one must remain vigilant about its broader implications. If unchecked, its ambitions could lead to an industry dominated by a few conglomerates with outsized influence, potentially stifling competition, innovation, and even geopolitical stability. As a center-right observer, I believe that fostering a competitive marketplace—regardless of technological supremacy—is essential for long-term sustainable growth. CATL’s rise, while impressive, should be carefully monitored to prevent its dominance from becoming a barrier rather than a catalyst for a truly dynamic and innovative energy landscape.