In recent years, Western narratives around technological supremacy have been built on a shaky foundation. While the United States has long held a dominant position in certain segments of the global tech industry, this image is increasingly fragile. The recent praise by Nvidia’s CEO, Jensen Huang, for Taiwan Semiconductor Manufacturing Co. (TSMC) underscores an uncomfortable truth: global semiconductor innovation is not solely an American affair. The illusion that the U.S. can unilaterally control or dominate the chip industry neglects the reality of deep integration, strategic partnerships, and technological prowess in Asia—particularly Taiwan and China.

The U.S. government’s push through legislation like the CHIPS Act aims to bolster American manufacturing, but these efforts are often more symbolic than transformative. They attempt to recreate a past era where the U.S. was the undisputed leader in microchip technology. The reality is that Taiwan, admittedly with significant U.S. support and investment, has become the heart of global chip production. Similarly, China’s investments and strategic moves complicate the narrative of American dominance, exposing it as more fragile and vulnerable to geopolitical shifts than widely acknowledged.

Technological Interdependence Over Sovereignty

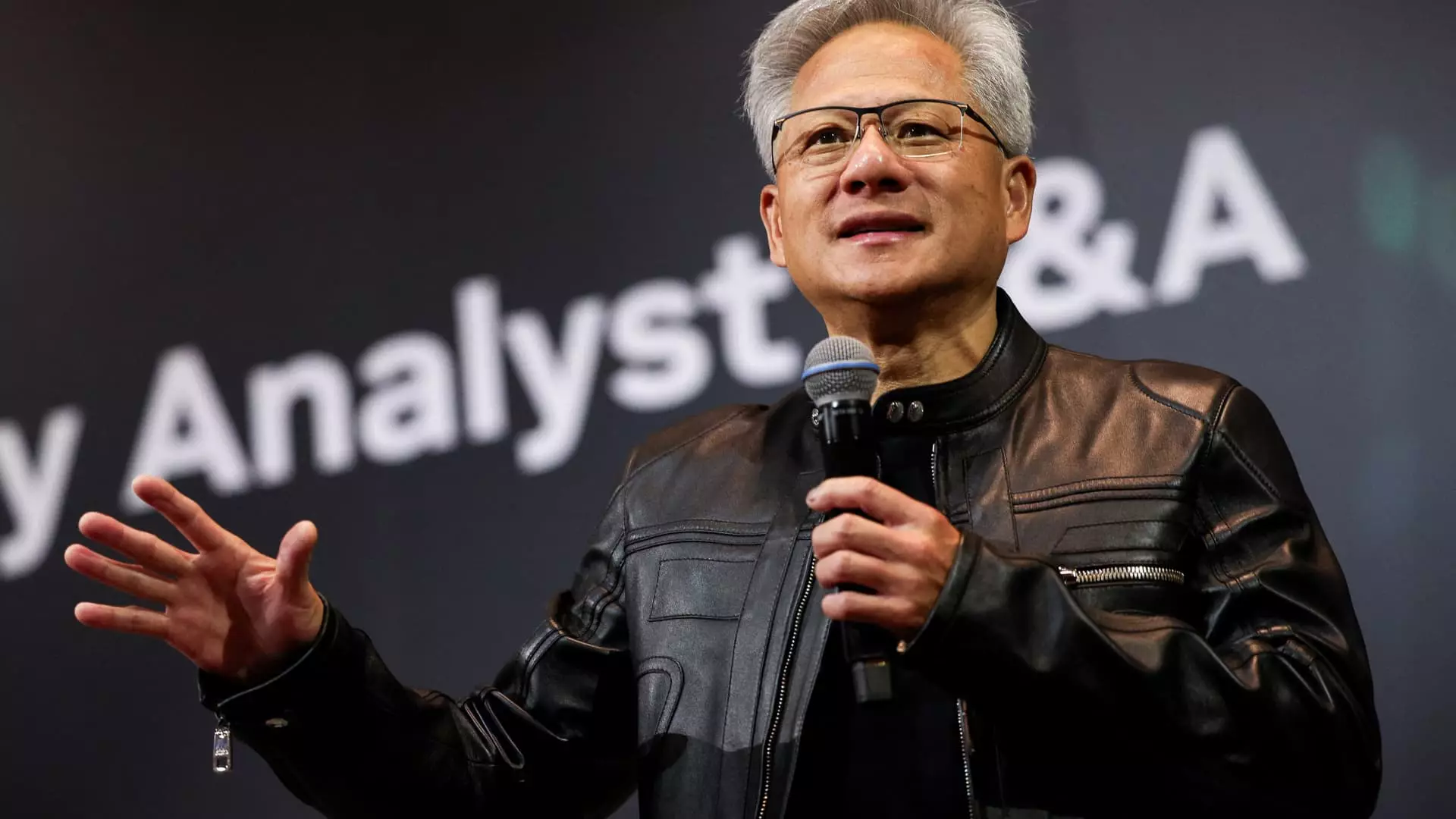

Huang’s public admiration for TSMC’s innovation and strategic importance is no accident. It reveals a pragmatic understanding that Taiwanese and Chinese firms are vital to the global tech ecosystem—a point often overlooked by hawkish policymakers in Washington. His endorsement of TSMC as “one of the greatest companies in the history of humanity” is not merely patriotic flattery; it highlights the company’s unmatched technological capability and the reality that American chip companies are heavily reliant on Taiwan’s manufacturing prowess.

Despite U.S. pressures to limit reliance on foreign supply chains, the global semiconductor industry has become a complex web of cooperation. American firms, like Nvidia, depend on Taiwanese design and manufacturing expertise, just as Chinese firms are key players in the supply chain. By trying to isolate Chinese and Taiwanese companies, the U.S. risks cutting itself off from essential innovation and increasing costs—inevitably hampering its own technological progress in the process.

The Strategic Flaws of U.S. Protectionism

Washington’s ambition to acquire stakes in companies like TSMC and Intel reflects a misguided desire to control or influence the industry directly. While sectioning off strategic assets might seem like a shield against geopolitical threats, such policies often produce the opposite effect: they undermine trust, hinder collaboration, and slow technological innovation. Don’t forget—when the U.S. government moots taking a 10% stake in Intel or similar moves, it signals uncertainty rather than strength.

This strategy also neglects the fact that technology evolves through open collaboration and competition—not government-backed monopolies or administrative stakes. The idea that U.S. government investments or takeovers can drive innovation at the same pace as private enterprise and international cooperation is naive. Instead, it risks turning the U.S. into a less attractive partner for Taiwanese and Asian firms, who might seek other markets or suppliers in response.

American Exceptionalism in the Tech Sector Is Overrated

The narrative that the U.S. maintains an insurmountable lead in semiconductor technology is increasingly unsustainable. While national pride has historically driven American innovation, today’s technological landscape is shaped by cross-border collaborations, fierce competition, and rapid technological diffusion. Nvidia’s growing presence in Taiwan, as well as TSMC’s expanded U.S. investments, exemplify this interconnected reality.

In addition, the recent restrictions on Nvidia’s chips bound for China—such as the H20 general processing units—highlight the limits of America’s strategic controls. China’s security concerns and the freeze on certain high-tech exports reveal a deepening bifurcation in global supply chains. Nevertheless, China and Taiwan are quietly continuing to innovate, regardless of U.S. sanctions or restrictions. This ongoing resilience undermines the U.S. narrative of technological omnipotence and suggests a future where power is dispersed rather than centralized.

The Geopolitical Strategy of Embracing Rather Than Suppressing

A pragmatic, center-right approach recognizes that technological leadership depends less on isolationism and more on strategic engagement. Building strong partnerships with Taiwan and China—while ensuring national security—may ultimately serve long-term U.S. interests better than attempted monopolies or hostile takeovers. American tech companies such as Nvidia have already shown they benefit from a globalized supply chain, and efforts to double down on protectionism may erode their competitive edge.

Moreover, fostering a sense of cooperation in the industry, rather than confrontation, can yield technological breakthroughs that benefit the global economy. The assumption that economic and technological strength resides solely within the U.S. borders diminishes the reality of a multipolar world where collaboration, talent, and innovation are shared across borders—not hoarded or antagonized.

This perspective challenges the conventional narrative—disguised as patriotism—that America must retreat into protectionism to maintain technological dominance. Instead, it emphasizes that strategic cooperation and realistic diplomacy with Taiwan and China are essential components of a resilient and competitive technological future.

In essence, clinging to the myth of American tech superiority is increasingly outdated. Embracing a pragmatic, cooperative stance with Taiwan and China not only recognizes the reality of today’s interconnected tech world but positions the U.S. to remain influential in shaping the future of global innovation.