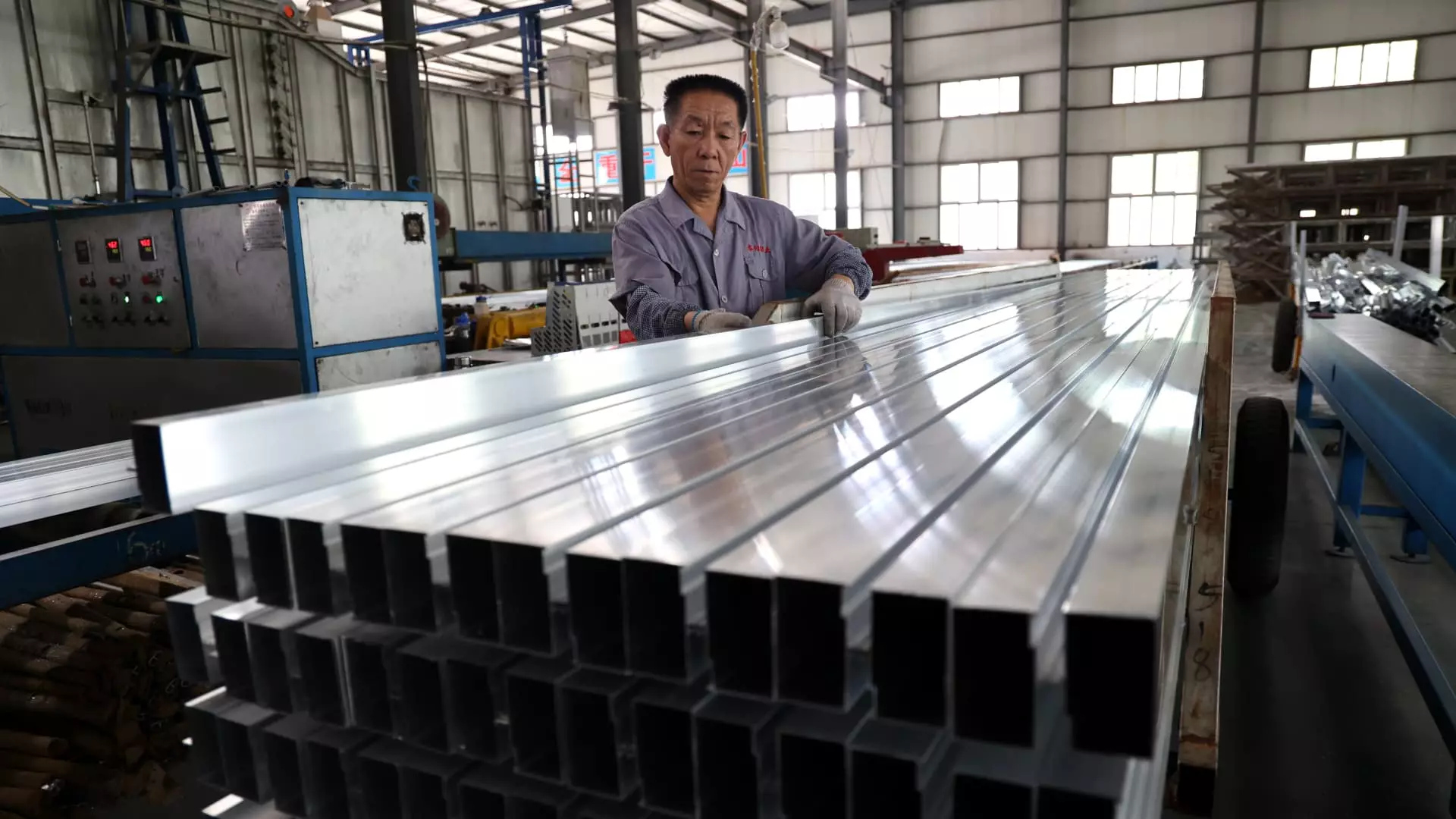

The relationship between the United States and China has been fraught with tension, particularly regarding trade policies and tariffs. As President Donald Trump’s administration moves forward with plans to implement tariffs on a variety of imports, manufacturers in China are preparing for a significant impact. Initially, Trump’s focus may have been on Canada and Mexico, but the implications for China have become a pressing concern. This article delves into the ramifications of the proposed tariffs on Chinese manufacturers and examines their strategic preparations to mitigate potential fallout.

President Trump has long maintained that imposing tariffs will ultimately benefit the U.S. manufacturing sector and create jobs for Americans. However, this approach is not without its downsides. The scheduled 10% tariffs on imports from China, slated to take effect soon, have significant potential to escalate costs for American consumers. The price of goods ranging from electronics to home furnishings is expected to rise, placing a greater financial burden on the average consumer.

Many Chinese manufacturers, recognizing the impending risks, are adjusting their business strategies to counteract the possible adverse effects of these tariffs. For instance, Harry Li, a furniture seller operating out of Guangdong province, has opted to increase his product shipments to the USA. By stockpiling inventory in advance, Li aims to sidestep the immediate consequences of the tariffs. This tactic, however, comes with its own challenges, as it necessitates higher prices for consumers. Li’s experience highlights how tariffs can create a ripple effect, where the end costs are ultimately borne by the consumer.

The struggle to adapt does not end with merely stockpiling goods. Zheng Yu, who produces water purification systems, has described plans to relocate parts of his manufacturing process to third-party countries. His ambition is to establish assembly lines beyond China’s borders—potentially in locations such as Vietnam, Malaysia, or even Dubai. Zheng’s decision reflects a profound shift in strategy among Chinese exporters who find themselves at a crossroads. The challenges presented by tariffs are prompting many to explore alternative manufacturing bases, which could save them from the punitive costs imposed by the increasingly hostile trade environment.

However, relocating production is not without trade-offs. While such moves may offer a solution to mitigate tariff impacts, they often come with heightened operational costs and logistical complexities. For Zheng, the choice of Dubai, despite its higher expenses, signifies the lengths manufacturers are willing to go to maintain their foothold in the lucrative U.S. market. The potential for splitting tariffs with U.S. clients further illustrates the intricate negotiation required amidst uncertainty.

The most troubling consequence of these rising tariffs is the changing perception of the U.S. as a viable market for Chinese exporters. Leng Rong, a skincare product manufacturer, has voiced concerns about the viability of his company in exporting to the U.S. given the high tariffs imposed during Trump’s previous term. The notion that the U.S. was once the “greatest market” is rapidly evolving; with increased unpredictability and tariffs consistently altering the landscape, many manufacturers are reconsidering their options.

This shift not only affects current trade relationships but also poses long-term threats to the health of the Chinese manufacturing sector. Leng’s sentiment resonates with others who feel the repercussions of the trade tensions directly. For many manufacturers with already thin profit margins, increasing tariffs might force them to withdraw from the U.S. market completely, which would have dire implications for both their businesses and the broader economic relationship between the two countries.

The evolution of tariff policies under the Trump administration presents a formidable challenge to Chinese manufacturers. The threat of tariffs not only drives strategic adjustments but fundamentally alters the dynamics of international trade relationships. As manufacturers grapple with rising costs, the need for adaptability becomes paramount. The outcomes of these trade tensions will invariably reshape the future of manufacturing in China and its access to the U.S. market.

In this fraught environment, the willingness of companies to innovate and seek new paths is critical. Whether through stockpiling goods, relocating production, or reevaluating target markets, businesses must navigate these uncertain waters with caution and creativity. As long as tariff-driven tensions persist, the interplay between U.S. and Chinese manufacturing will remain a key area to watch in the global economic landscape.