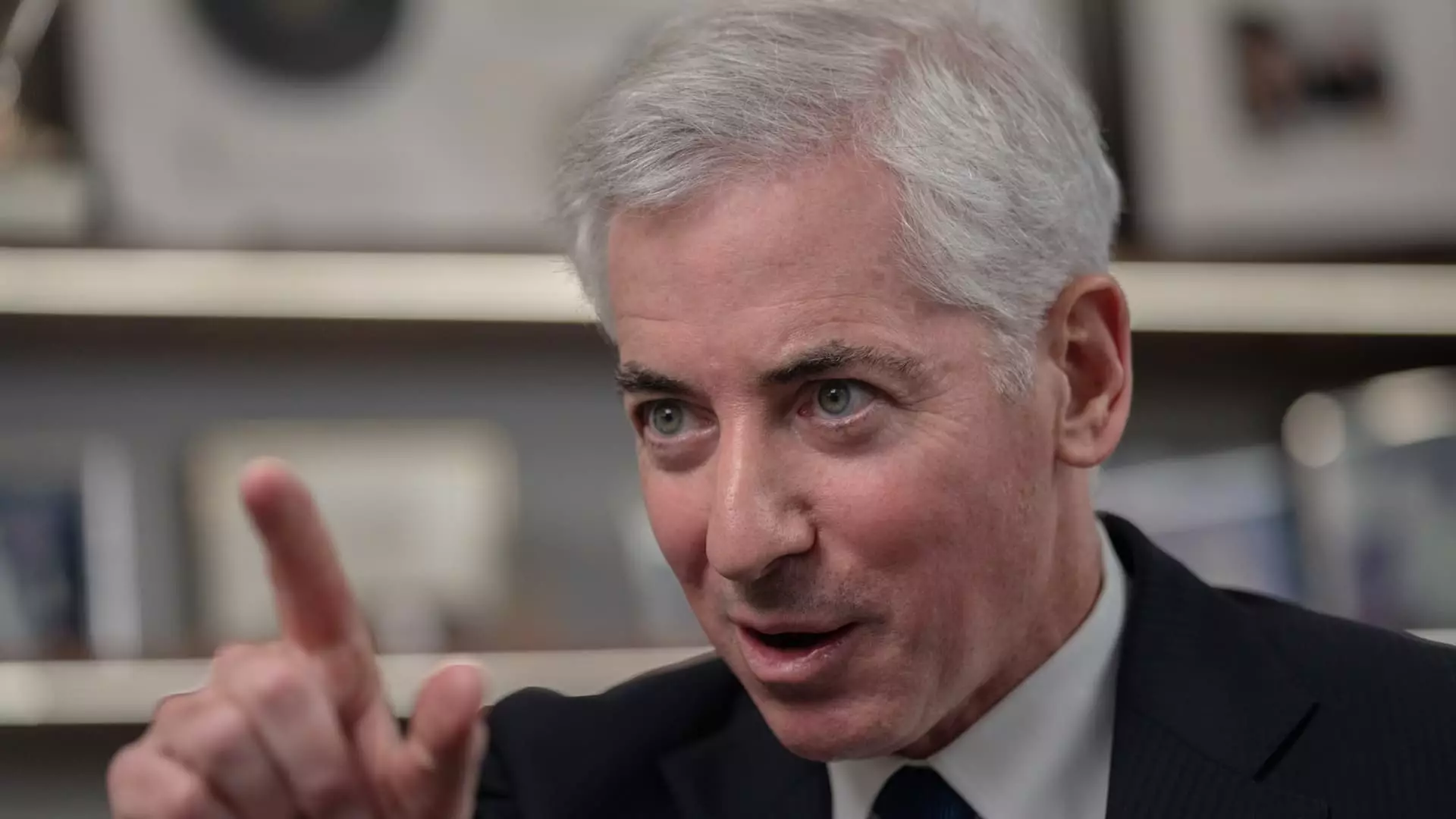

In a landscape characterized by immense economic fluctuations, the recent pause in “reciprocal” tariffs announced by President Trump has ignited both optimism and apprehension among American financial elites. Bill Ackman, a prominent hedge fund manager, quickly transformed his relief into public praise, showcasing the unpredictable yet often theatrical nature of Trump’s economic strategies. While some thrived in this atmosphere of uncertainty, others, like Ackman, found themselves in a precarious position, grappling with the duality of support and concern stemming from these developments.

The Power of Negotiation Through Tariffs

Ackman’s enthusiastic endorsement of Trump’s negotiating tactics serves a dual purpose. On one hand, he applauds the strategic use of tariffs to fortify America’s trading position. His reference to Trump’s tactics as “brilliantly executed” underscores a fundamental belief among many center-right economists: that a strong stance can yield favorable outcomes. This perspective embraces the belief that economies can be recalibrated to favor domestic stakeholders, thus reinforcing the importance of selective tariffs. However, the underlying question remains: at what cost do these strategies come?

A Balancing Act Between Strategy and Panic

While Ackman celebrates the pause in tariffs, he simultaneously warns of the seriousness of the situation. His cautionary commentary regarding an impending “economic nuclear winter” reveals a crucial aspect of Trump’s fiscal approach—its volatility. The fine line between negotiation and recklessness is perilously thin, and Ackman’s oscillation between praise and caution highlights an inherent risk in exceptionalism, particularly in the economy. It begs a broader inquiry into whether such negotiating tactics will ultimately strengthen or weaken the very fabric of American financial stability.

Public Sentiment and Market Confidence

“If business is a confidence game,” Ackman asserts, “then the President is losing the confidence of business leaders.” This statement not only encapsulates the current sentiments among the financial elite but also mirrors the anxieties of everyday Americans. The unpredictability of the market during Trump’s presidency has led to a rise in skepticism among stakeholders who prefer stability over uncertainty. While the temporary relief from tariffs brings a shimmer of hope, it simultaneously ignites fears of instability, leaving many questioning how sustainable these policies truly are.

A Divisive Economic Philosophy

As a center-right liberal, I find myself at a crossroads in this debate—acknowledging the potential benefits of strategic economic manipulation while also critiquing the chaotic methodology that often accompanies it. Trump’s governance showcases an approach that is both audacious and erratic, engendering a culture where risk is embraced, yet consequences loom large. The polarized opinions within the financial community, symbolized by Ackman’s fluctuating views, speak volumes about the broader implications of such governance: will it foster a renewed American vigor or lead us down a path of economic despair?

Ackman’s commentary also raises questions about the ethics in the cabinet. His abrupt shift from criticism of Secretary Lutnick to a more tempered view emphasizes the complexities of navigating economics during such incendiary political periods. Perhaps even more troubling is how this reflects a larger discourse about accountability within financial landscapes, especially when personal interests may clash with national well-being. All these factors contribute to a convoluted environment, where clarity remains elusive amidst the economic tempest.