Temu, the Chinese e-commerce platform that once basked in the radiance of a flourishing advertising campaign, has recently seen a drastic reversal in its fortunes. Once celebrated for its extravagant slogan, “Shop like a billionaire,” this innovative retail contender garnered significant attention following its Super Bowl ad exposure. The platform dominated the digital landscape, luring American bargain hunters with a vast array of products priced well below market value. However, the tide appears to be turning for Temu as it faces staggering operational and marketing challenges in response to the escalating tariffs imposed by former President Donald Trump.

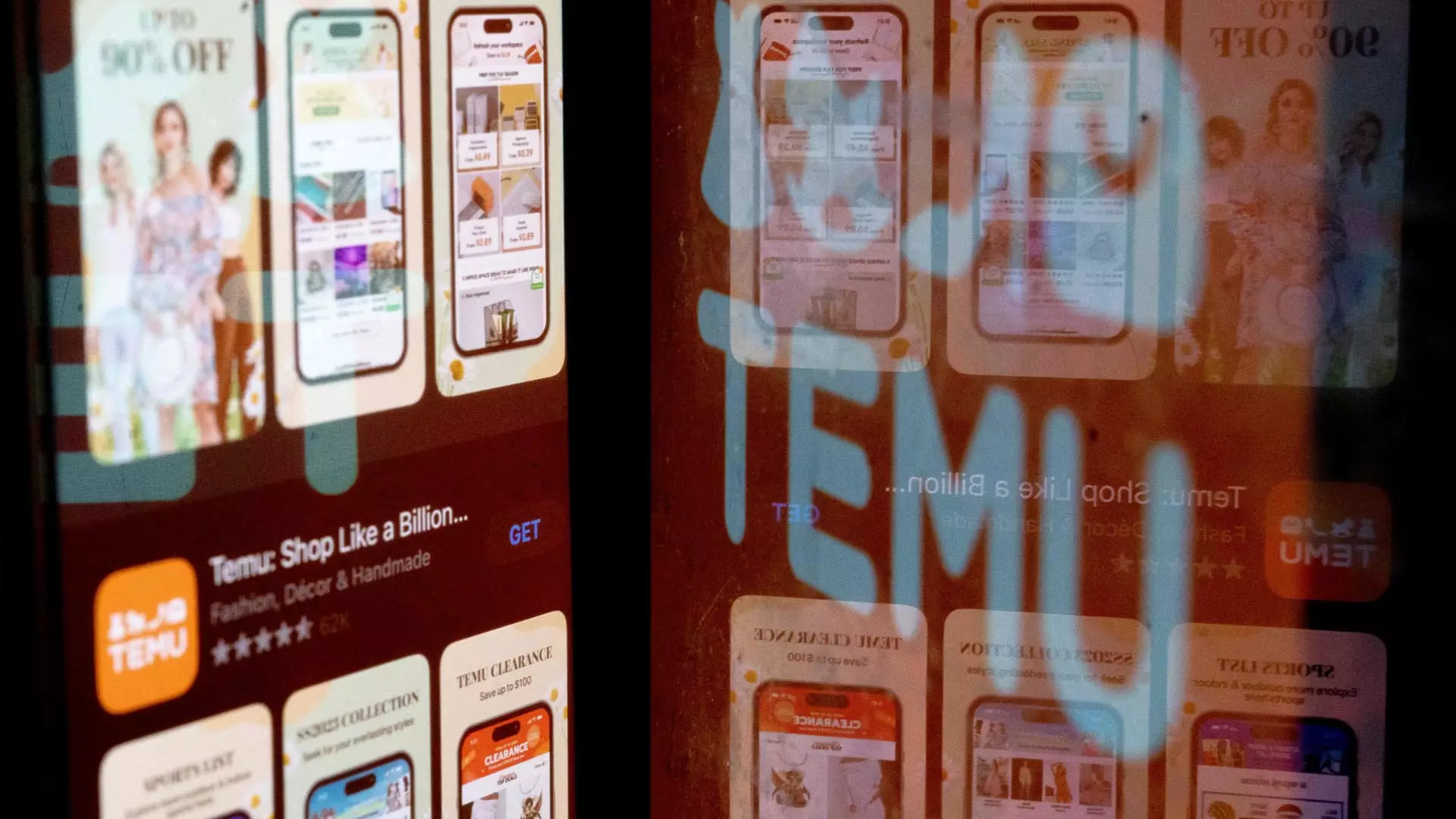

Temu’s meteoric rise to the top of the App Store charts has been nothing short of extraordinary. For two consecutive years, it was a household name among American users, frequently appearing among the top downloaded free apps. Yet, the company’s dramatic shift in strategy, marked by an almost complete cessation of advertising, signals troubling times ahead. Based on analyzed data from SimilarWeb, Temu’s app downloads plummeted by 62% following the unveiling of the new tariff regime. This decline, while attributed to a myriad of external factors, directly reflects the company’s inability to navigate the increasingly hostile landscape of U.S.-China trade relations.

The Impact of Trump’s Tariffs

President Trump’s sweeping tariffs on goods imported from China have served as a proverbial wrench in Temu’s business model machinery. The stark reality is that packages shipped from China now face an unprecedented tariff rate of 145%, a heavy burden that no company, regardless of its size, can easily absorb. Moreover, the impending abolition of the de minimis provision, which previously allowed duty-free shipments valued under $800 to enter the U.S., is set to further constrict Temu’s operational profitability.

In response, Temu has already publicly announced its intent to hike prices in light of mounting operational costs. This bold move may backfire; consumers thrifty by nature may recoil at inflated prices, leading to diminishing sales figures. The question arises whether Temu can maintain its allure amid rising costs, compounded by fierce competition from rival platforms like Amazon and Shein, which harness similar supply chains.

Shifting Advertising Strategies

As Temu’s advertisements disappear from platforms that once served as its primary marketing channels, the company’s struggle has become evident. Early analyses indicate that their paid advertising traffic, which had previously eclipsed organic traffic by more than twofold, has since dropped a staggering 77%. This fall underscores a potentially devastating blow to the brand’s visibility, which has historically relied on digital marketing avenues such as social media and Google ads to capture consumer attention.

With the e-commerce landscape growing increasingly competitive, the implications of this advertising retreat are profound. While Temu once commanded significant market share through aggressive ad spending—accounting for 20% of U.S. Google Shopping ad impressions—its current absence leaves a vacuum for established competitors like Amazon and Shein, who continue to maintain robust advertising efforts.

The Competitive Landscape in E-commerce

Temu’s struggle is not occurring in isolation, as rival platforms like Alibaba’s Taobao and Beijing’s DHgate have recently seen a surge in downloads amid Temu’s decline. In fact, while Temu plummets in rankings, competitors are latching onto the opportunity for growth. DHgate recently ascended to the No. 2 spot in the app store, indicative of a seismic shift in consumer preference as shoppers rally around platforms that continue to deliver affordability.

The landscape is not merely a competition of budget-friendly offerings; it is also one of adaptability. Temu’s need for dynamic advertising tactics and operational agility cannot be overstated. As the market evolves, companies must demonstrate foresight and resilience to withstand external pressures. While some analysts suggest that Temu may eventually reestablish its advertising operations in the U.S., the overarching question remains whether they can reclaim the ground they once held.

The decline of Temu serves as a bitter reminder of how volatile the e-commerce landscape can be, particularly under the strain of fluctuating trade policies. Once a rising star in the online retail realm, Temu’s current plight exposes the complex realities of global commerce where barriers, taxes, and tariffs have immediate, tangible effects on market players. It is difficult to predict the trajectory of Temu’s journey; however, their adaptive strategies in the face of adversity will be paramount in determining their survival. The road ahead will demand innovative approaches, and perhaps even a reevaluation of Temu’s initial business philosophy, if they are to emerge from these challenging waters.