In a moment that reveals a troubling shift within the Federal Reserve’s traditionally cautious ranks, newly-confirmed Governor Stephen Miran’s bold dissent signals a dangerous misconception about the role of monetary policy. Instead of aligning with the consensus that supports gradual rate reductions aimed at fostering sustainable growth, Miran’s call for a half-point cut—double the amount favored by his colleagues—reflects a reckless appetite for aggressive easing. Such a stance undermines the Fed’s long-standing commitment to steady, predictable policy that preserves financial stability amid economic uncertainties.

While other governors like Michelle Bowman and Christopher Waller maintained their support for a modest quarter-point cut, Miran’s divergence stands as a clear statement that he prioritizes quick and substantial rate reductions over cautious calibration. This divergence is not just a procedural anomaly; it exposes a fundamental misjudgment about the risks of aggressive easing in an environment where inflation remains relatively contained. Treating the economy as if it’s on the verge of crisis may be appealing in ideological terms, but it distorts the delicate balance of monetary policy, risking overheating or creating artificial asset bubbles.

The Political Overtones and Personal Ambitions

Miran’s stance cannot be divorced from the broader political context. His appointment by President Donald Trump—amid a backdrop of tensions between the administration and the Fed—raises legitimate questions about independence. By openly advocating for a significantly lower rate—an eyebrow-raising proposal from a newly-installed governor—Miran’s position seems more aligned with political expediency than sound monetary stewardship. His willingness to take an unpaid leave from the White House’s Council of Economic Advisors further complicates this picture, blurring the lines between policy independence and political allegiance.

Furthermore, Miran’s vocal dissonance could be a calculated move to position himself as a more “serious” and aggressive policymaker—perhaps attempting to signal to the administration and markets that he is willing to push the boundaries of conventional monetary policy. This is dangerous because it dismisses the importance of consensus in a central bank tasked with balancing multiple economic objectives. His stance, if influential, could tip the entire outlook for the economy towards unnecessary volatility.

The Illusion of Power and the Risk of Overreach

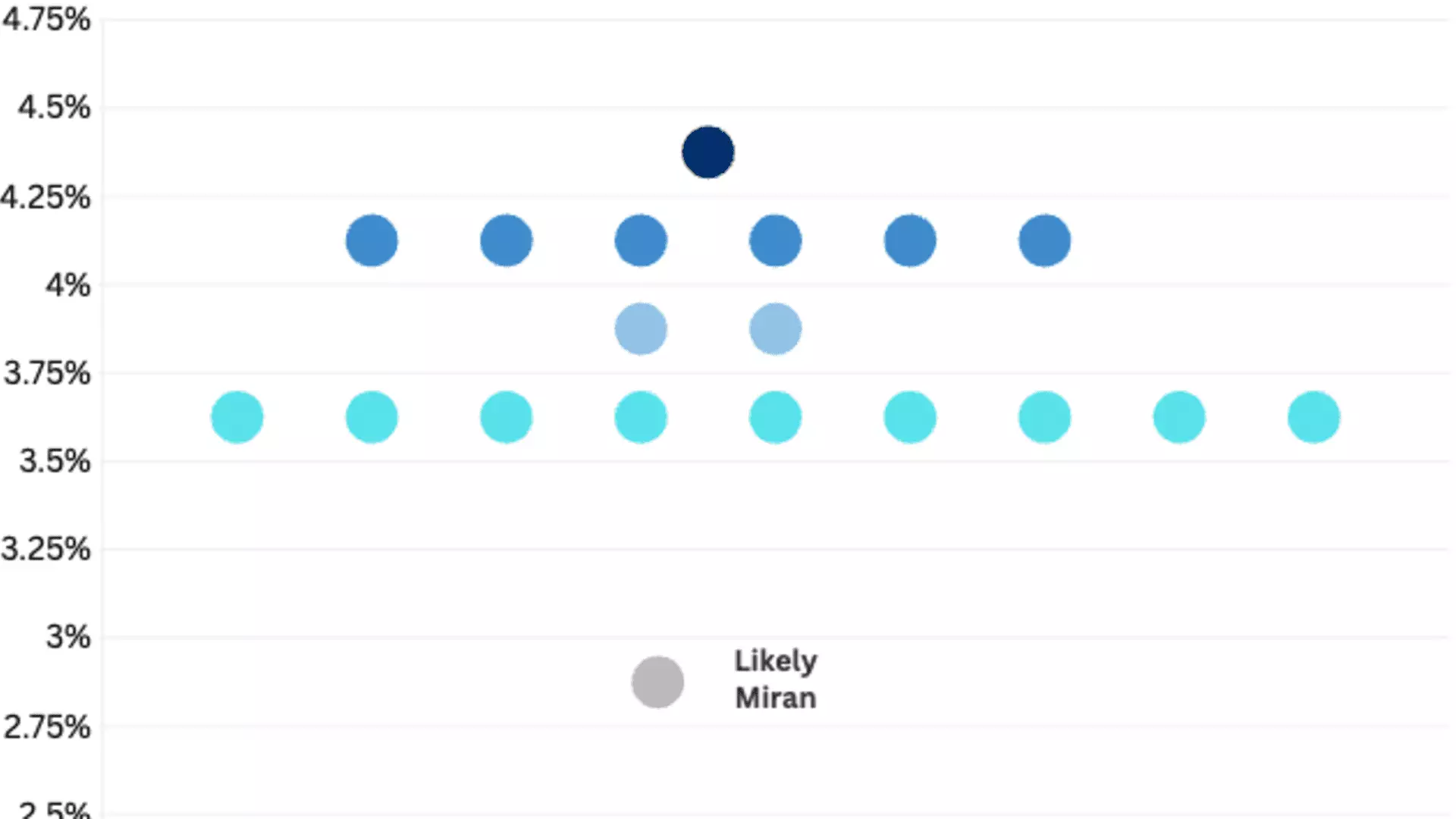

It’s important to recognize the broader implications of such dissent. The FOMC’s dot plot, which showcases the collective outlook of committee members, illustrates substantial disagreement on the future of rate cuts—particularly in 2026. Miran’s more dovish view, possibly influenced by political bias, inflates the risk of overestimating economic vulnerabilities that don’t merit such aggressive interventions. Central banks, by design, are bastions of pragmatic restraint, and deviating from that principle invites the danger of creating artificial economic conditions that are unsustainable in the long run.

The fact that Miran was confirmed shortly after Trump’s failed attempt to remove Federal Reserve Board Chair Lisa Cook—who remains protected by judicial rulings—adds a layer of political gameplay to these monetary policy debates. The administration’s apparent use of appointments and potential influence over rate policy suggests attempts to sway the Fed’s traditionally independent decision-making process. Such interference risks transforming the central bank from a neutral steward into a political tool, which can be disastrous for investor confidence and economic stability.

The Necessity of Caution in an Uncertain World

The urge for bold, swift rate reductions like Miran’s is not rooted in economic necessity but often in political theater and personal ambition. In a complex economy dealing with a myriad of structural challenges, drastic policy shifts are not just unnecessary—they are potentially perilous. The Fed’s approach should be guided by data and prudence, not ideological fervor or political favoritism.

The broader market and economy depend on the perception that the Fed acts independently and responsibly. When dissenters push for dramatic rate cuts, they risk undermining the credibility of this institution. It is essential that the Fed’s leadership resists the temptation of populist, politically motivated policies that threaten to destabilize the very foundations of economic confidence and growth. Leadership within the Federal Reserve must prioritize stability and risk management over shallow signals of boldness that, in reality, threaten long-term prosperity.