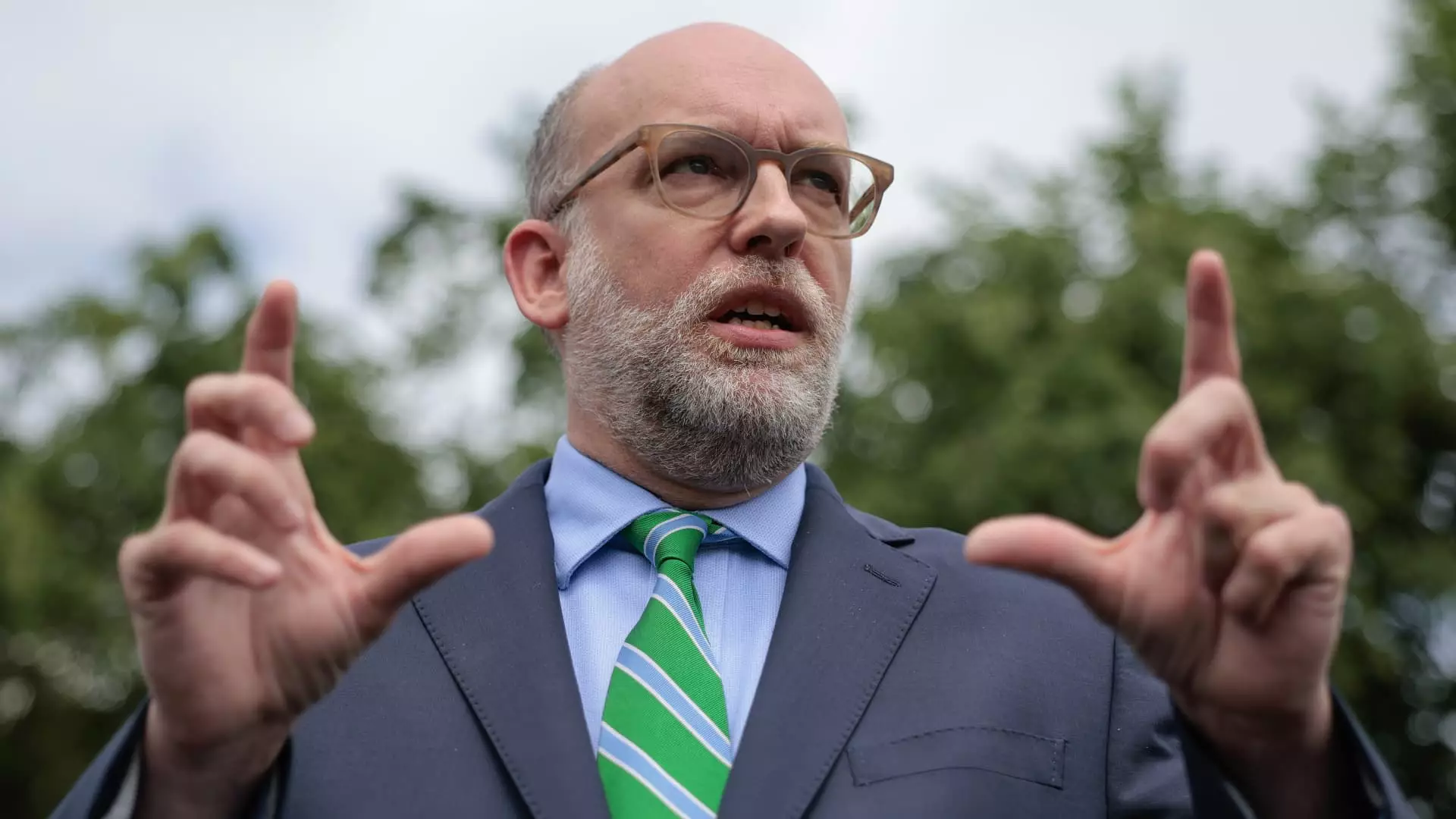

In an era where government transparency is often just a veneer, the recent obsession with the lavish renovations of the Federal Reserve headquarters epitomizes the disconnect between public perception and actual fiscal stewardship. The claim that a bipartisan system, ostensibly designed to safeguard national interests, is instead entangled in costly excesses reflects a troubling divergence from true accountability. The recent assertions by officials like Russell Vought—regarding the $2.5 billion project—are less about genuine oversight and more about political theater. While conservatives champion fiscal discipline, their focus on overblown projects and bureaucratic mismanagement reveals a significant blind spot: the tendency to scrutinize minor excesses while ignoring systemic inefficiency.

The claim that the Federal Reserve, an institution with a critical role in stabilizing the economy, is guilty of “mismanagement” over a building renovation might stir public outrage or pique political interest. But underlying this is a deeper question: Why do these projects escalate so dramatically in cost? Is it a failure of good governance, or simply the nature of federal projects, which are often shielded from real accountability by layers of bureaucracy and political manipulation? There is a clear importance in holding government agencies accountable, but real change occurs when the focus is on overarching policies and structural reform, not just headline-grabbing issues like building embellishments.

Politicization of Central Banking as a Symptom, Not a Solution

The controversy surrounding Fed Chairman Jerome Powell and the allegations of mismanagement serve a different purpose. They are emblematic of a broader struggle—an ongoing effort by some in the political right to politicize the Federal Reserve. While Chairman Powell insists that monetary policy is independent, rhetoric from the administration and their allies increasingly suggests that the Fed is not immune to political pressure. This trend highlights a dangerous shift in how central banking is perceived: from a technocratic tool designed to maintain economic stability to a pawn in partisan battles.

The push by Trump administration officials to question the Fed’s operational decisions reflects a desire to control economic narratives, often under the guise of fiscal conservatism. However, such efforts threaten to undermine the credibility of the central bank—an institution tasked with safeguarding monetary stability, not serving political ends. The repeated accusations, whether about building costs or rate decisions, reveal a troubling preference for political convenience over genuine economic expertise. This erosion of independence fosters uncertainty, which can be more damaging than any short-term interest rate increase or decrease.

The Myth of Overspending: A Reflection of Systemic Flaws

The narrative that the Fed is a “palace” of excess feeds into a larger misconception: that government institutions are inherently wasteful when they indulge in projects beyond their core mission. But this obsession misses the mark. The real concern is not extravagant building costs; it’s the underlying inefficiency embedded within the entire system of government oversight. Federal agencies often lack the incentives for cost-saving discipline, leading to bloated budgets and poorly managed projects that are seldom scrutinized.

Moreover, the focus on renovations ignores the broader implications of how federal agencies manage their priorities and resources. If the primary goal is economic stability, why are these superficial issues allowed to dominate political discourse? The real problem isn’t just that some project has gone over budget but that the entire system is susceptible to mismanagement—funded and protected by political interests that prefer stability and maintenance over genuine reform. Focusing narrowly on building costs risks diverting attention from the urgent need for structural accountability in how the government manages its various agencies.

The Political Agenda and the Threat to Institutional Integrity

The recent appointment of White House-affiliated officials within oversight bodies signals a troubling trend: an attempt to influence and possibly intimidate institutions that are supposed to operate independently. This politicization of oversight bodies, enabled by appointments with direct ties to the White House, erodes the pillars of institutional integrity. The message is clear—if an agency refuses to align with political interests, it risks being targeted for blame or even removal.

This strategy isn’t merely about seeking accountability; it is about consolidating political power by undermining institutions that might challenge executive preferences. The attempt to connect trivial issues, such as building costs, to calls for the Chairman’s resignation appears designed to create a narrative that the entire institution is corrupt or mismanaged. Such tactics threaten to weaken the independence of the Federal Reserve and other agencies vital to economic stability. A system that is vulnerable to politicized attacks risks systemic failure, as confidence in the institution erodes.

The Broader Impact on Economic Policy and Stability

This uncontrolled politicization has real-world consequences. If the Federal Reserve begins to appear beholden to political whims, markets will react with increased volatility, which undermines the very stability they are tasked to defend. The recent delays in interest rate adjustments, justified by political rhetoric, threaten to destabilize economic growth and exacerbate inflation, affecting working Americans the most.

Furthermore, the narrative that the Fed is mismanaging its core responsibilities feeds into populist demands for more aggressive political control over monetary policy. While some argue that rate hikes or cuts are purely technical decisions, in reality, they are deeply political, especially when driven by external pressure. When political figures threaten to dismiss Fed officials or politicize appointments, it undermines the credibility that central banks worldwide rely upon. Such undermining can lead to a loss of investor confidence and increased borrowing costs—consequences that the average citizen pays for indirectly.

The truth is, the battle over building renovations is more than just about a “palace”—it is a microcosm of larger systemic issues surrounding accountability, independence, and economic sovereignty. When political actors leverage minor grievances to attack foundational institutions, they jeopardize the delicate balance that maintains economic stability and trust. The challenge lies not merely in scrutinizing cost overruns but in resisting the temptation to weaponize institutional vulnerabilities for short-term political gain. Without steadfast defense of independent central banking and a refusal to scapegoat institutions for broader policy hesitations, the path ahead looks perilous for America’s economic future.