Super Micro Computer, a key player in the AI server market, experienced a substantial surge in its stock, climbing 16% after the firm met the Nasdaq’s deadline for filing its postponed financial results. This development has led investors to a renewed sense of confidence in the company, following a tumultuous period marked by significant operational and governance struggles. The released financial statements, audited by BDO, were deemed compliant with Generally Accepted Accounting Principles (GAAP), signaling a return to a semblance of stability for Super Micro.

For the fiscal year concluding on June 30, 2024, Super Micro reported a remarkable increase in revenue, with sales skyrocketing to $14.99 billion—more than doubling from $7.12 billion in the previous year. Additionally, net income rose to approximately $1.15 billion from nearly $640 million in the 2023 fiscal year. These figures illustrate a strong market demand for their servers powered by Nvidia’s graphics processing units, catalyzed by the surge in AI technologies following the emergence of tools like ChatGPT.

However, beneath this financial success lies a cloud of concern. The company’s management disclosed some alarming internal control weaknesses related to financial reporting. Such issues included significant IT challenges, inadequate documentation concerning manual journal entries, and insufficient safeguards to ensure proper segregation of duties among staff members. These weaknesses pose substantial risks, revealing that growth may not be as unencumbered as the numbers suggest.

In response to these internal challenges, Super Micro has pledged to bolster its accounting and audit teams, alongside upgrading its IT frameworks. This proactive approach is crucial; however, it still raises questions about the company’s governance structure and whether the remedial measures will fully address the identified weaknesses. Concerns linger regarding legal implications, possible credit downgrades, and reputational damage stemming from the delays in financial reporting and prior governance issues.

As Super Micro navigates through these complexities, the shadow of potential litigation adds an additional layer of pressure on the stock, which has faced volatility over the past year. The stock saw a staggering year-over-year decline of 48%, underscoring the challenges that have plagued the company.

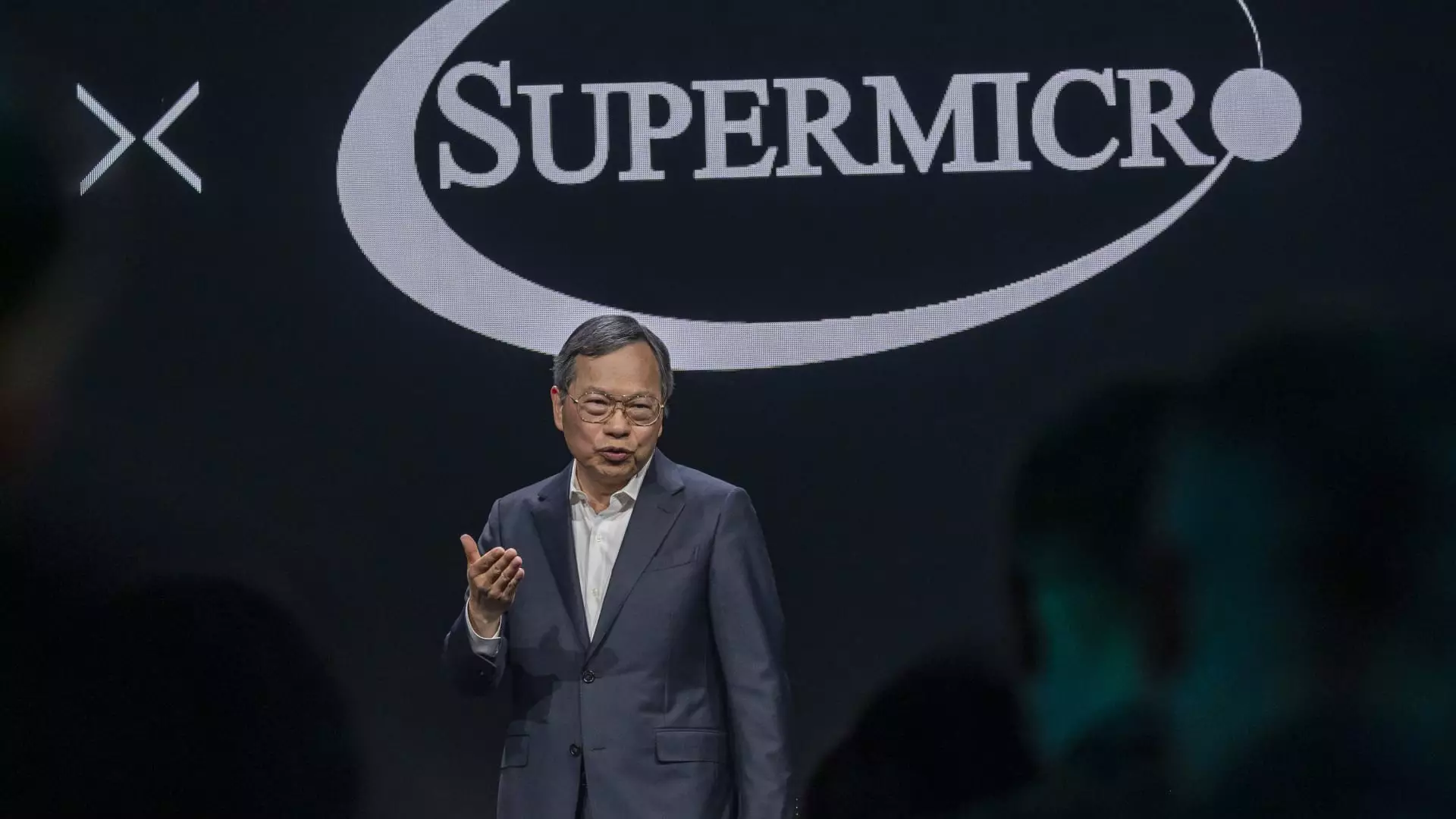

In light of the recent financial disclosures, CEO Charles Liang expressed optimism regarding meeting future regulatory deadlines, indicating a commitment to compliance with the U.S. Securities and Exchange Commission. Such confidence is vital, especially after the upheaval that saw the company’s CFO ousted due to governance concerns.

Ultimately, while Super Micro’s financial performance paints a promising picture, the underlying issues related to internal controls present a critical narrative for investors to consider. As the company steps into a new era of accountability and aims to capitalize on the burgeoning AI market, continuous scrutiny will be essential to ensure that past vulnerabilities do not hinder future growth. The onus is now on Super Micro to translate its financial promises into operational realities, which will define its path forward in a competitive landscape.