The Consumer Financial Protection Bureau (CFPB) finds itself in a precarious position, as recent developments threaten its operational stability and effectiveness. With an ever-changing political landscape and the recent actions taken by newly appointed acting Director Russell Vought, the CFPB’s future is uncertain. This article explores the implications of these changes, the controversy surrounding the CFPB’s existence, and the potential consequences for consumers.

Last Sunday, employees at the CFPB were instructed to work remotely due to a decision to close the organization’s Washington, D.C. headquarters until February 14. This abrupt shift in operational policy, communicated in a memo by Chief Operating Officer Adam Martinez, signals a troubling trend for an organization already under scrutiny. The directive follows an email that Vought sent on Saturday, which called for a suspension of nearly all supervisory activities concerning financial institutions. Such actions raise eyebrows, as they illustrate an unprecedented level of disruption within the agency.

The move to remote work, while not uncommon in today’s global context due to the COVID-19 pandemic, in this scenario appears to be more politically motivated than simply a health precaution. Reports of Musk-affiliated employees from DOGE gaining access to CFPB data and internal reviews amplify fears regarding potential organizational manipulation. This creates an environment of tension amongst employees, as they may feel unable to voice their concerns for fear of repercussions in such a hostile workplace.

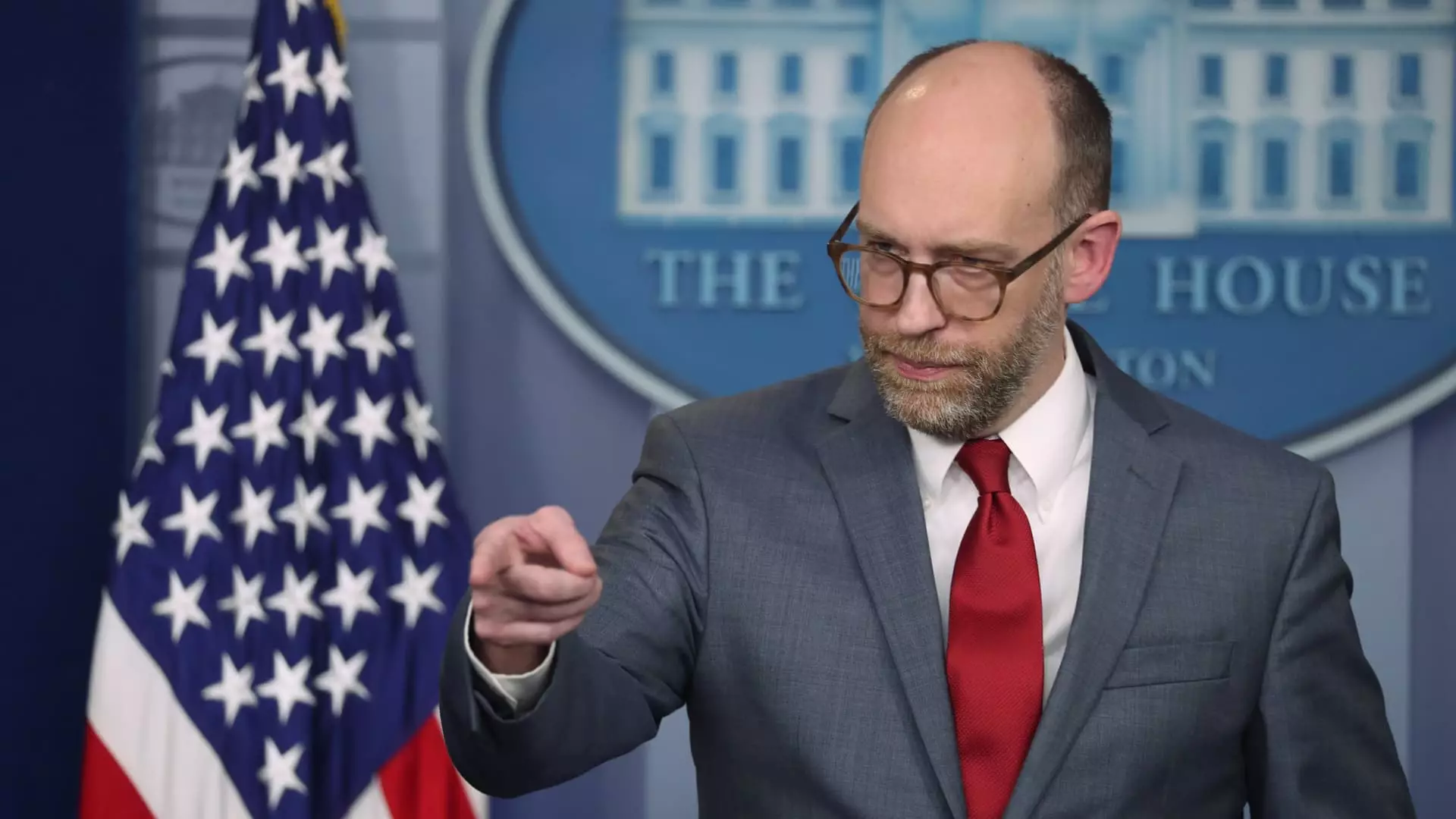

The backdrop of these developments is deeply intertwined with political maneuvering. Russell Vought’s appointment comes amidst a larger plan articulated by the Trump administration known as Project 2025, which seeks sweeping reforms across the federal government. Vought’s previous role as the head of the Office of Management and Budget suggests a strategic intent to reshape how agencies like the CFPB operate. His recent Twitter declaration about halting funding to the CFPB further solidifies this notion, depicting a clear intention to choke the organization financially.

This political intervention comes at a time when the CFPB is crucial in safeguarding consumers against potentially exploitative practices in the financial sector. The agency was established in response to the 2008 financial crisis, with the goal of protecting American consumers from unethical banking practices. The long-standing animosity between the CFPB and various bank trade groups has intensified in recent years, with accusations of overreach and unfounded regulatory authority.

One of the most alarming aspects of the CFPB’s current predicament is the potential for layoffs or even a complete restructuring of the agency. With about 1,700 employees, many of whom work on essential consumer protection initiatives, significant changes could have dire ramifications for the enforcement of rules designed to prevent financial exploitation. Should Vought’s directives materialize into mass layoffs, critical CFPB programs aimed at saving consumers billions—such as restrictions on credit card fees and interventions regarding medical debt—could be severely compromised.

The chilling chilling effect of this political drama cannot be understated. Legal experts and advocates fear that continued erosion of the CFPB’s capabilities may lead to a resurgence of predatory financial practices. Additionally, consumers who rely on the agency for oversight and protection may find themselves increasingly vulnerable without a robust regulatory body to safeguard against systemic risks.

The trajectory of the Consumer Financial Protection Bureau is now filled with uncertainty as it grapples with intense political pressures and operational disruptions. The ramifications of Vought’s leadership style combined with Musk’s seemingly antagonistic posture towards the agency paint a bleak picture for consumer advocates. As the CFPB continues to navigate this turmoil, it remains to be seen how the agency will adjust and whether it can maintain its foundational mission of protecting the interests of consumers from the financial industry’s excesses. The stakes are high, and the outcomes will significantly impact American consumers across the nation.