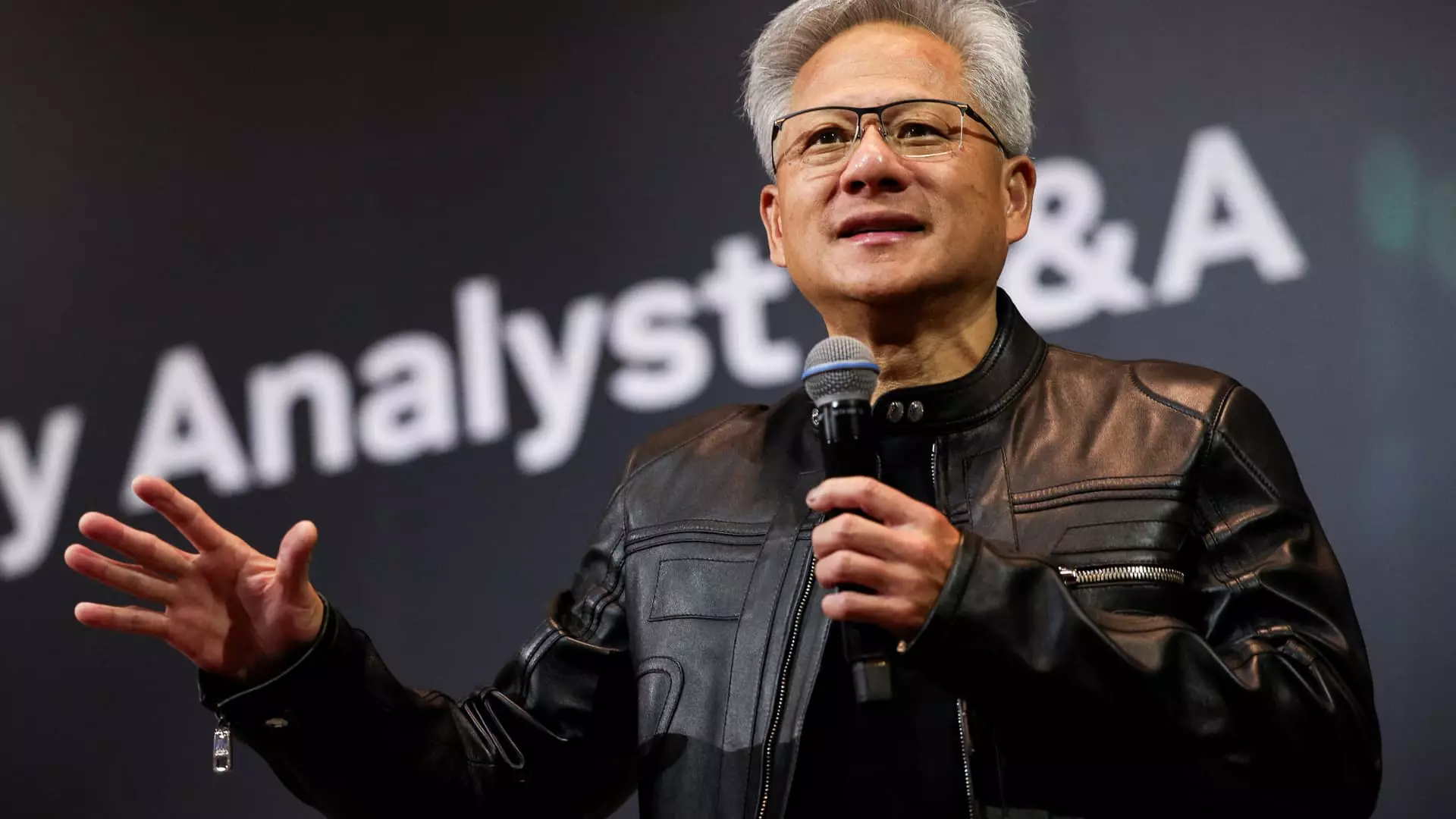

Jensen Huang’s recent massive share sales raise eyebrows and cast shadows over Nvidia’s soaring reputation. When a company’s CEO liquidates a significant portion of their holdings, it often triggers speculation about internal confidence levels. Huang, a founder synonymous with Nvidia’s explosive growth, has offloaded over 300,000 shares valued at nearly $50 million within a week—a move aligned with his pre-planned sale schedule. While planned, timing becomes critical. Are these sales a mere routine rebalancing or a discreet signal that the executive is hedging bets against an uncertain near-term future? Given the unparalleled valuation Nvidia commands—surpassing $4 trillion—such sales should be scrutinized for potential internal doubts about the company’s long-term trajectory.

The Political and Regulatory Crossroads

Adding a geopolitical layer, Nvidia’s return to the Chinese market for its H20 chips is a complex chess game. The U.S. government’s signal to approve export licenses demonstrates a delicate balance of interests: safeguarding national security concerns while maintaining lucrative trade alliances. For Nvidia, this is more than just a business decision; it’s a strategic maneuver that could set a precedent. Huang’s expressed desire to sell more advanced chips to China hints at a nuanced approach that could potentially complicate U.S.-China relations further, especially in the context of the ongoing technology rivalry. The fact that the company is optimistic about obtaining licensing approval suggests confidence in the political climate, yet it remains a gamble that could backfire if geopolitical tensions escalate.

The Implications for Investor Trust

While the market continues to revel in Nvidia’s AI dominance and record valuations, the sales activity by Huang raises uncomfortable questions. Investors often interpret insider selling combined with signals of strategic market expansion as a sign of cautious optimism or, worse, transient cheerleading. Are these sales indicative of a founder cashing out at the peak of his company’s value? Or are they simply steps in a broader financial plan? The truth remains elusive, and the lack of transparency around insider transactions breeds suspicion—especially when one of the industry’s most influential figures trims his holdings amid a period of unprecedented growth.

Could the CEO’s Portfolio Shifts Signal Overconfidence or Instability?

Huang’s stock sales, while legally and strategically planned, could be perceived as a subtle indicator of overconfidence in Nvidia’s future—selling at a time when the company’s market cap is at an all-time high might suggest he anticipates near-term volatility or a plateau. Such moves, often dismissed as routine, can also point to internal reassessments of personal wealth versus corporate health. If the CEO is liquidating significant portions of his stake, some investors might question whether he sees cracks in Nvidia’s armor—be it in regulatory hurdles, geopolitical risks, or impending market saturation.

The Broader Economic and Strategic Ramifications

Ultimately, the ongoing insider sales and geopolitical maneuvers serve as a stark reminder that high-flying tech companies are not immune to internal and external pressures. Nvidia’s ascendancy is genuine, but it is also fragile—classic overconfidence may give way to vulnerabilities masked by soaring stock prices. The company’s ambition to push chips into China, despite global tensions, underscores its strategic boldness but also highlights the delicate tightrope it must walk. For investors in Nvidia and the broader tech ecosystem, these developments should be viewed not as reassurance but as cautionary signals that even the most innovative companies face internal doubts and external threats that could reshape their future.